India

Entrepreneur

Finance

A more painless way to pay bills

This app allows people to pay for their rent and bills using their credit card. It gives them freedom to manage their money, keep all their payments in one place and makes sure everything stays completely secure.

India

Entrepreneur

Finance

A more painless way to pay bills

25% of people struggled to pay their bills during the pandemic and the cost of living crisis that followed, hasn’t helped. Money problems affect almost every aspect of your life, from mental and physical health, to relationships. Financial stress has a huge impact on your quality of life.

The pandemic highlighted how crucial it is to have a firm grasp of your cash flow. That’s what the founder behind this FinTech app set out to solve – how to create an easy and secure way for people to manage their rent and bills. And what if these payments gave people something back too?

Builder Studio Pro

Fintech app

34 features

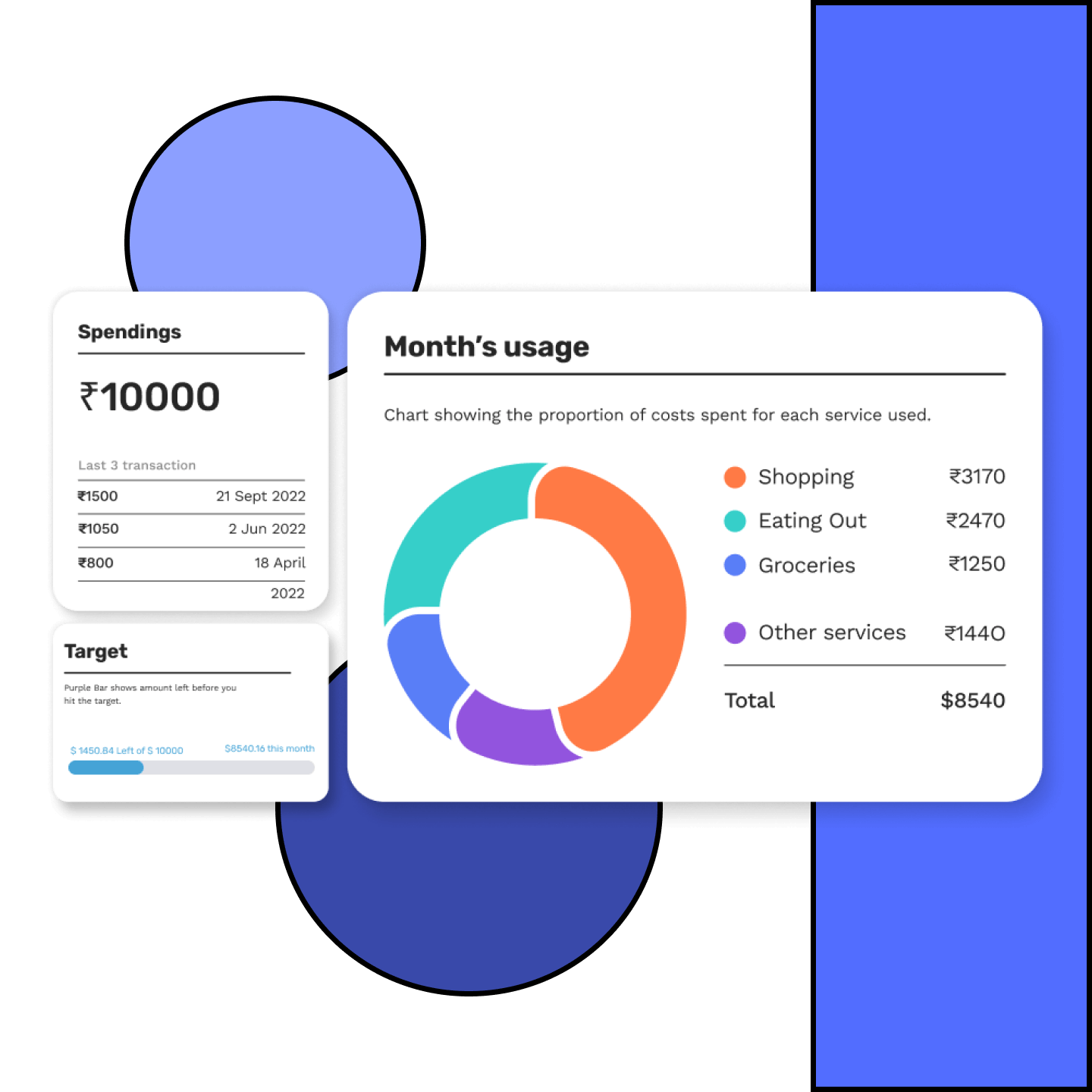

This app gives its users complete visibility of their cash flow – with automatic receipts for every payment. By keeping all payments in one place you’re much less likely to get unexpected payments or forget a bill. Finally, the app offers cashback and rewards on top.

App users can sign up for free and use it to send payments to anyone (they don’t need to be signed up to the app too). So there’s no awkward discussion trying to get your landlord to sign up and there’s total flexibility with the payments you want to make.

All payments made through this app are instant and come with its own digital receipt. All transactions are broken down into spending categories (from rent, to gas and electricity, TV or school fees). That way, it’s easy to keep track of all your spending.

Advanced Encryption Standard (AES) is the global standard for encryption, used by everyone from WhatsApp to the US government – who even use it for data that’s classified as Top Secret.

All passwords, credit cards, and bank account details in the app are encrypted with AES encryption, and transactions are secured with 128 bit SSL encryption. So users know their transactions will remain safe and secure. Before making transfers, users have to confirm both their identity and the recipient’s. The app then checks that these account numbers line up.

For many people, rent is an expense with a penalty if it’s late. Instead, this app gives its users rewards – direct cashback – for making rent or bill payments.

This FinTech app’s founder understood that while times are tough, people need help. So rather than vouchers that only work at a list of specific shops, users can earn up to ₹30,000 just by making regular payments.

A system for accepting and processing credit/debit payments, with transaction histories and payment status. Users add their card details, giving them control and making purchases simpler and faster.

Use categories and subcategories to organise and group data, products, listings or posts. Helps manage large amounts of data, and can benefit users when they want to search and filter items.

Create coupon codes to be used for the product. This feature is often used to attract shoppers wanting a bargain, and to build brand loyalty and improve customer experience.

A dashboard for users to view and manage (including reply, mark, delete) notifications of activity. Shows unread notifications to highlight what's recent and encourages users to open and see what's been received.

An admin dashboard for managing payments. Gives users one place to understand cashflow, by understanding what's coming in and going out.

Generate and send invoices to customers. Includes the option to generate recurring invoices, to save time and effort.

Store customer credit card details inside the product. Saves time and improves the checkout experience by not having to enter card details each time.

Software as easy as ordering pizza

Reach us