When was the last time you visited a bank to transfer money or had to fumble with banknotes to pay at a coffee shop?

Chances are, it’s been a while. From digitally splitting bills to managing investment portfolios, there’s been an explosion in the fintech industry in recent years.

However, there’s been little innovation in how enterprises handle their finances. Many still rely on Oracle or SAP systems that are hard to use, expensive to maintain and have no integration capabilities. Plus, these systems often lack secure user authentication and fail to provide real-time cash positions.

This is where fintech software can help your business. It allows you to manage your cash, remove inefficient financial processes and provide real-time data, all while complying with regulations.

In this blog, we’ll explore the challenges fintech software addresses, the various types of fintech software available and how Builder.ai makes it easier than ever to build it 👇

What is fintech software?

Fintech software is a digital system designed to automate and streamline financial processes for organisations. It facilitates a range of functions such as automated payments, risk management, data analysis and regulatory compliance. It's designed to integrate seamlessly with existing systems and offer scalability and security to large volumes of transactions.

Challenges solved by fintech software

Complex financial processes

As your company grows, its financial operations become more complex. They often become multi-layered, involving multiple stakeholders and systems. Managing these processes manually can lead to inefficiencies and errors.

These long-tail financial processes not only slow down your business operations but can cause big losses. The downfall of Enron in the early 2000s is one such example where a company lost huge sums of money due to complex financial processes.

Fintech software automates a lot of these processes, including payment processing, payroll and accounting. This results in a reduction of human errors, while speeding up transaction times.

Lack of real-time visibility

Enterprises usually have money scattered across multiple bank accounts, but can’t see it all at once. In other words, you don’t know how much is coming in, where it's coming from and where it’s going.

This lack of visibility makes it hard for you to understand your financial position in real-time. Because of this, you can’t make informed decisions on important matters like liquidity management and risk assessments.

Fintech software pulls all this information into one place and gives you a bird’s eye view of your cash flow, so you can make better decisions faster.

Poor integrations

Enterprises often buy smaller businesses. However, when that happens, they quickly realise the smaller business’s financial systems don’t integrate with their own.

This lack of integration can cause a lot of operational complexity and messy financial reporting.

Fintech software can be customised to fit the needs of your business. It can integrate your mismatched systems to make sure data flows smoothly and all systems communicate properly.

Regulatory burden

Keeping up with ever-changing regulations is tough, especially if your financial systems aren't up to the task. It usually means you need to assign more work for everyone or throw more people into the mix.

However, adding more people and processes results in more audits and reviews, which then leads to a vicious cycle of endless regulatory burdens.

Fintech software has compliance features, like automated reporting, audit trails, real-time monitoring and data encryption that help you reduce the risk of non-compliance.

Security concerns

Traditional financial systems often take security for granted. They lack strong user authentication, their data encryption is weak and their data storage is insecure.

This vulnerability can lead to huge financial losses. In fact, the average cost of a data breach in the United States is $9.44 million, and it takes an average of 277 days (almost 9 months) to identify and contain it.

Fintech software has robust security measures like multi-factor authentication, cloud storage, end-to-end encryption and real-time monitoring and alerts for security threats.

Types of fintech software

Accounting software

Accounting software handles all the financial transactions in your company. It tracks what’s coming in and what’s going out and provides a comprehensive view of overall financial health.

The software is designed to simplify the complex accounting processes and offers features like ledger management, accounts payable and receivables, multi-entity management and financial reporting.

Fintech platforms like Xero and FreshBooks are popular examples of accounting software.

Expense management software

Expense management software keeps tabs on every expense in your company. It tracks everything from office supplies to travel expenses and reimburses them without problems.

The software automatically categorises the expenses and syncs seamlessly with your accounting systems, significantly reducing the time spent on paperwork.

Expense management software like Expensify offers features like expense categorisation, receipt scanning, expense reporting and automated reimbursements. Additionally, it integrates with systems like accounting system, ERP and travel management system.

Payroll management software

Payroll software automates everything related to paying employees' salaries. This software makes sure everyone in your company gets paid the right amount at the right time.

It does this by calculating total salary, bonuses, overtime hours, taxes and other deductions.

Payroll software like MyndSolution offers features like direct deposit, generation of salary slips, real-time payroll tracking and automatic tax calculations.

Treasury management software

Treasury management software is a must-have for your finance team as it improves your financial operations. It streamlines processes like cash management, liquidity planning and financial risk management and makes sure that your business manages investments and financial assets properly.

The software helps you make data-driven financial decisions as it tracks your business’s daily cash flows, provides real-time insight into the financial status and helps with forecasting.

Popular examples of treasury management software are Kyriba and treasuryXpress.

Must-have features for fintech software

1 - Multi-level user authentication

Enhance security with multi-level user authentication to make sure only authorised users can access your financial information.

2 - Receipt scanner

Make it easy for users to scan and upload their expense receipts for quick reimbursements.

3 - Payment gateways

Enable online transactions through integrated payment gateways that support multiple payment methods like debit cards, credit cards, net banking and wallets.

4 - Real-time expense tracking

Real-time expense tracking monitors your spending and helps you stay on budget while maintaining accurate financial records.

5 - Budget forecasting and analysis

Budget forecasting and analysis tools help you predict future spending and assess financial performance. It allows you to create detailed budgets, forecast financial outcomes and make informed decisions.

6 - Financial reporting

This feature gives you a detailed analysis of your business’s financial performance and generates insights.

7 - Multi-level approval workflows

Multi-level approval workflows streamline accounting by enforcing a structured process for reviewing and approving financial transactions to ensure accuracy.

8 - Integrations

Streamline operations by integrating with other software types like ERP, inventory management, supply chain management and travel management.

9 - Dashboard

This feature gives you instant visibility on your key metrics while providing insights into user behaviour.

Who should you choose to build your fintech software?

When it comes to building your fintech software, you have a few options. Firstly, you can buy off-the-shelf software. These solutions can be deployed quickly and may cost less than developing custom software from scratch. However, they adopt a one-size-fits-all approach and may not meet the unique requirements of your business.

Secondly, you can develop fintech software internally. This approach allows for greater control over the development process. However, the downside is that your internal tech teams might already be stretched thin, and adding another project could overburden them.

Lastly, you can hire a dev agency as they can build robust fintech software with a range of custom features. However, working with agencies can come with its own set of challenges, such as unpredictable development costs and timelines.

Agencies might engage in practices like cost creeping, where unexpected invoices emerge periodically. Additionally, what might initially be quoted as a three-month project may overrun significantly.

This is where Builder.ai comes in 👇

Why Builder.ai is different?

Builder.ai gives you the best of all worlds by offering the flexibility of custom software development without the need to overextend your internal team or navigate the unpredictability of external agencies. With Builder.ai, you can build fintech software that's tailored specifically to the unique needs of your business.

Around 80% of all software is made up of around 650+ features. We package each basic feature as a reusable Lego-like block. Explain your idea to our AI companion, Natasha, and she uses these blocks to rapidly create an outline of your software.

The work is completed faster and cheaper because Natasha handles all the repetitive coding. Then it’s off to our software design team and software developers. They personalise it and create any bespoke elements you need.

To build your fintech software, simply head over to Builder Studio. The Builder Studio platform has been built with user convenience in mind and intuitively guides you through the software creation process.

Let’s dive in to the step-by-step process 👇

Create robust custom software today

100s of businesses trust us to help them scale.

Book a demoBy proceeding you agree to Builder.ai’s privacy policy

and terms and conditions

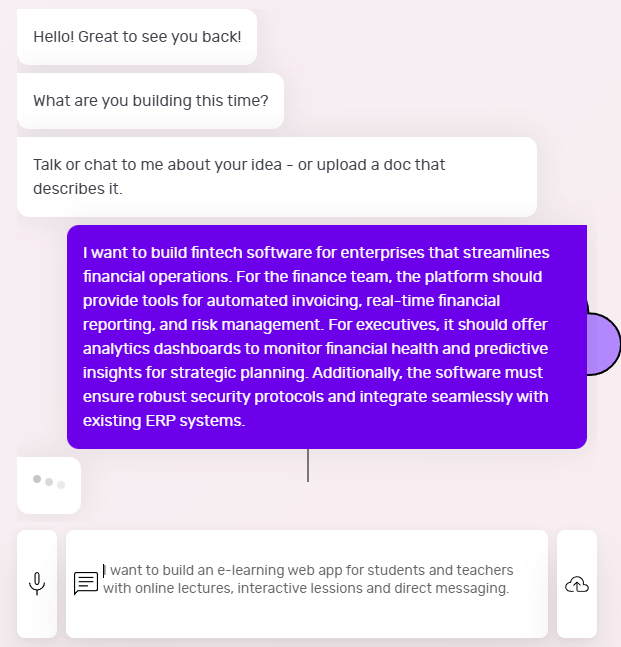

1 - Discuss your ideas with Natasha

On Builder Studio, you’re welcomed by Natasha. You can express your fintech software ideas to Natasha via voice, text or uploading a PDF or doc file.

Before you chat with her, have a checklist of software features and be as descriptive as possible about your software idea. The more detailed information you give to Natasha, the better her suggestions will be.

For instance, a prompt could look like this:

“I want to build fintech software that streamlines my business’s financial operations. For the finance team, the platform should provide tools for automated invoicing, real-time financial reporting and risk management.

“For executives, it should offer analytics dashboards to monitor financial health and predictive insights for strategic planning.

“Additionally, the software must ensure robust security protocols and integrate seamlessly with existing ERP systems.”

Based on your prompt, Natasha will ask you some supporting questions and you simply need to answer them based on your requirements.

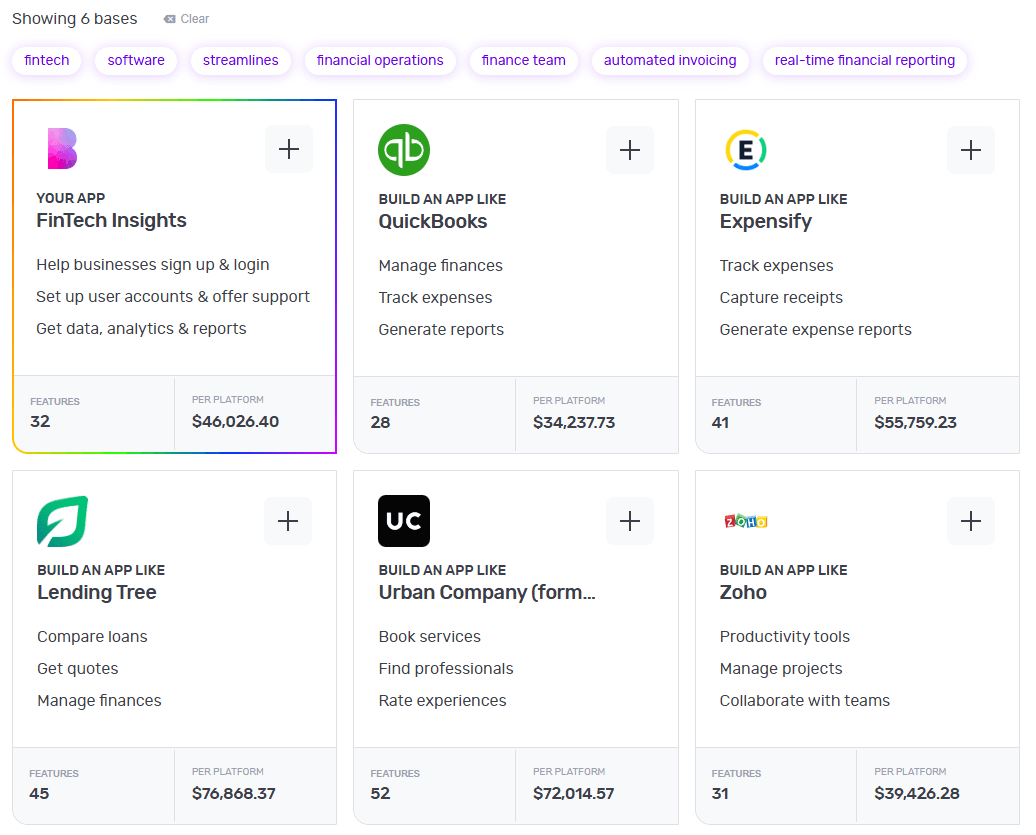

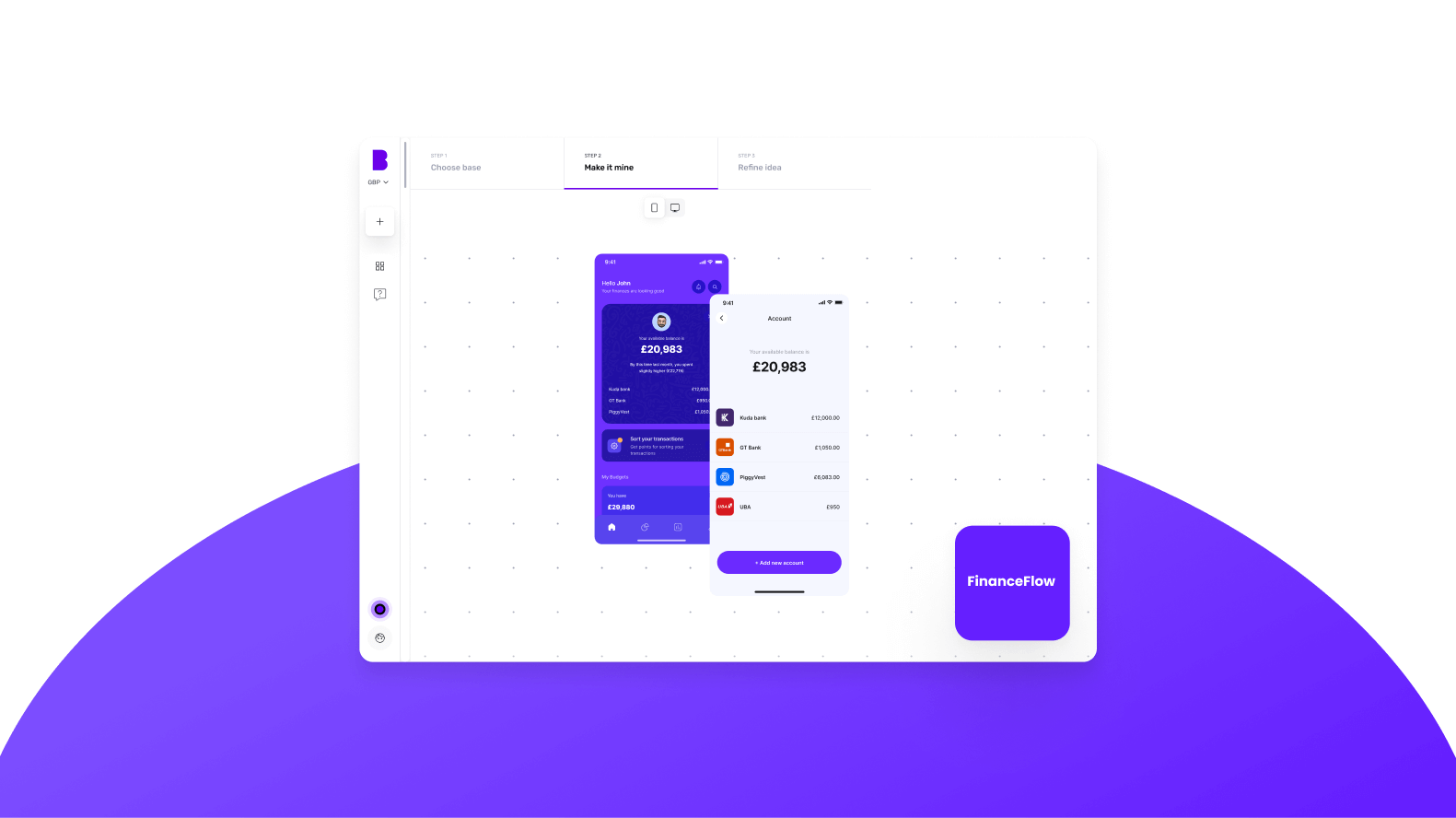

2 - Choose a base

Once Natasha has your requirements, she’ll create a custom framework for your software based on everything you tell her. She'll also suggest some pre-built bases she thinks are best suited for your software.

For instance, once you tell her to build fintech software, she’ll suggest a custom base similar to QuickBooks and share any matching core bases as well.

You can choose up to 3 you feel are related to your big idea by simply clicking the ‘+’ icon. These selections make it easier for us to understand the features your software needs. When you’re ready, click 'Next'.

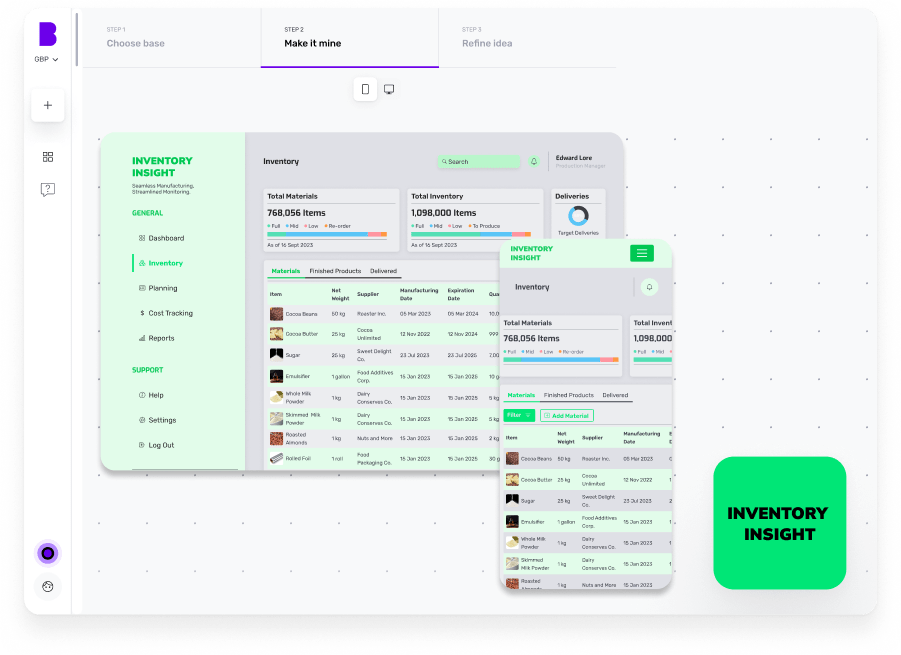

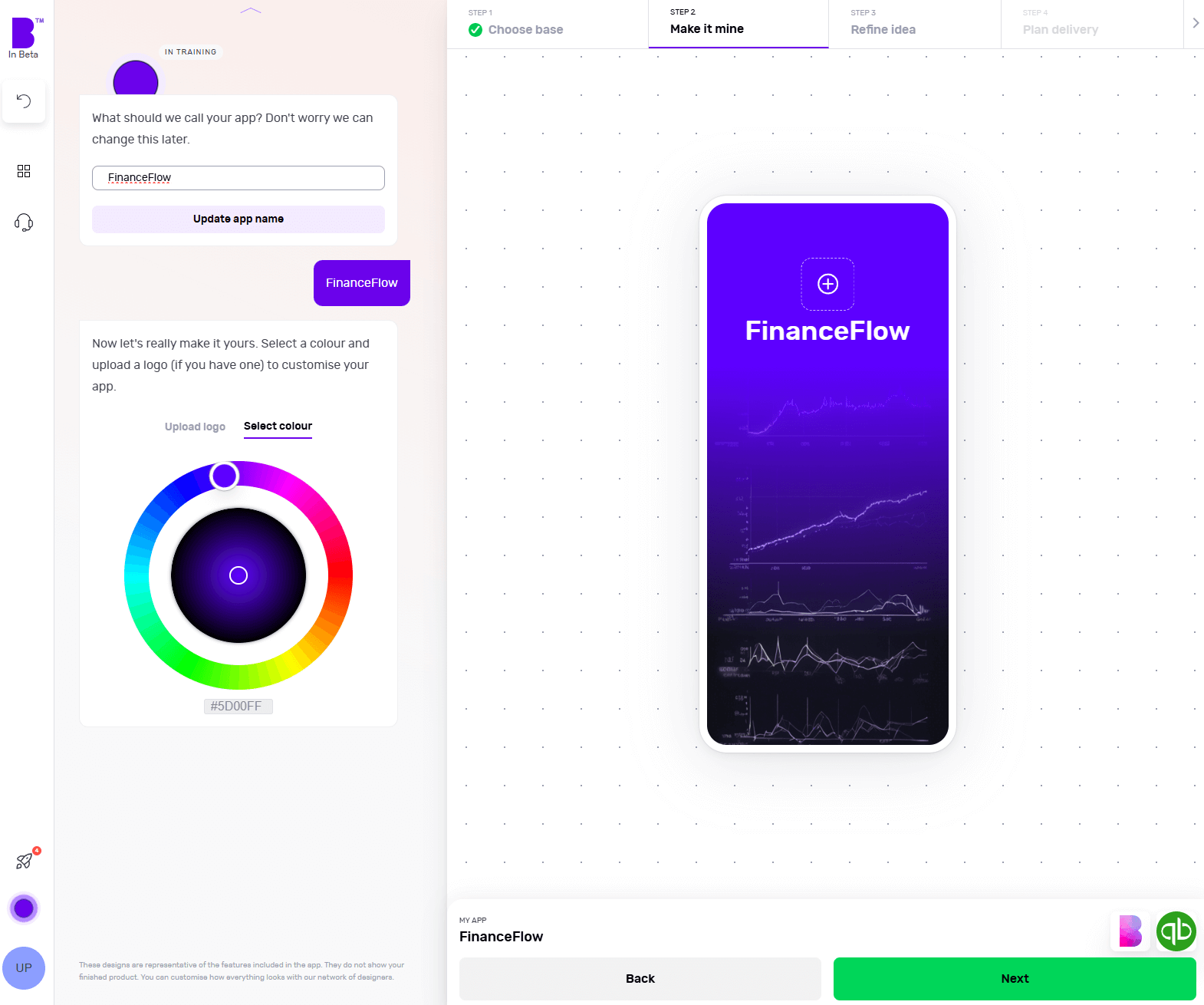

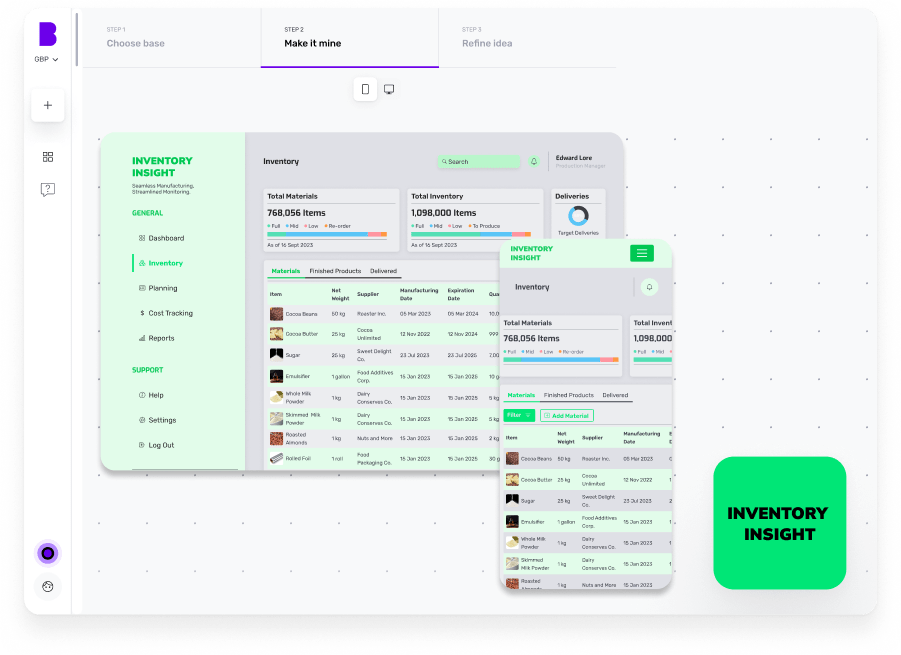

3 - Make it mine

The 'Make it mine' step aligns your software with the identity of your brand. In this step, you provide your software’s name, choose the colour scheme using the colour wheel and upload the logo of your brand.

Once you’ve personalised your software’s name, colour and logo, you can click ‘Next’.

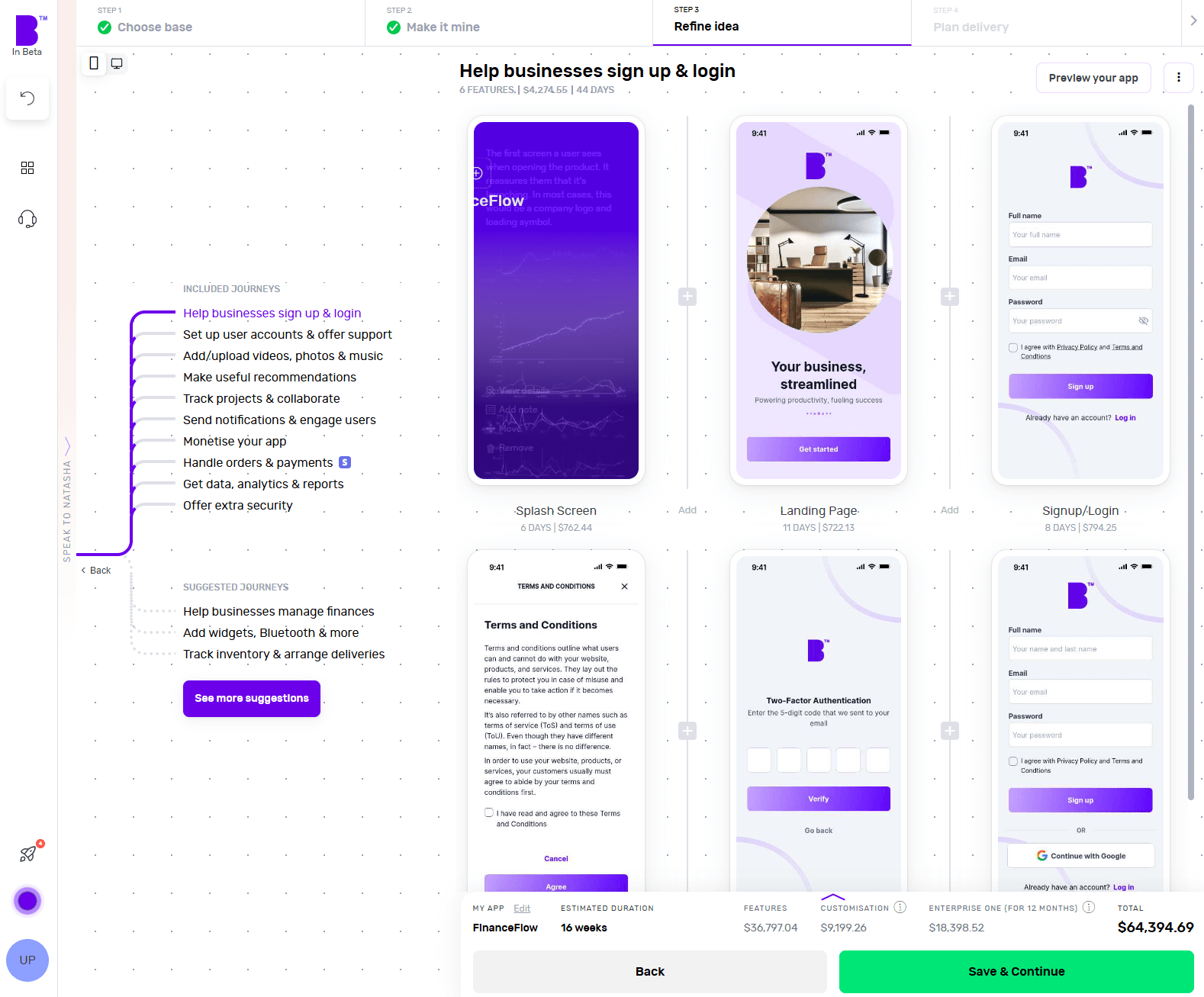

4 - Refine your software idea

Now comes the fun bit.

In the 'Refine idea' stage, you can review and customise your software journeys and features and also create an instant prototype of your software.

Journeys

In only a matter of seconds, Natasha createssoftware user journeys with corresponding features.

Go through these journeys carefully and see if your software needs additional journeys. For instance, check if you want to add journeys for tracking logistics, customised order status or any other relevant journey.

To add journeys, click on 'See more suggestions'. Doing so will open the list of pre-built journeys. You can browse the list and select the journeys you’re missing. You can also add custom journeys by clicking on 'Add custom journey'.

Features

By clicking on individual journeys, you can see the feature list each journey contains. Doing so will open the features list each journey contains. You can scroll through the features list and check if a journey contains non-essential features or if you want to add extra features.

To remove a non-essential feature, you can hover over the feature and click ‘Remove’. This way you can manage project costs. If you’re not sure what features to remove, you can click on an individual feature and check the label at the top. We highly recommend keeping the ‘Essential Features’.

In case you want to add more features, you can simply click the ‘+’ button. Here you can go through different categories or use the search bar to look for missing functionality. In case you don’t find the feature you’re looking for, you can also add a custom feature by clicking on 'Add custom feature'.

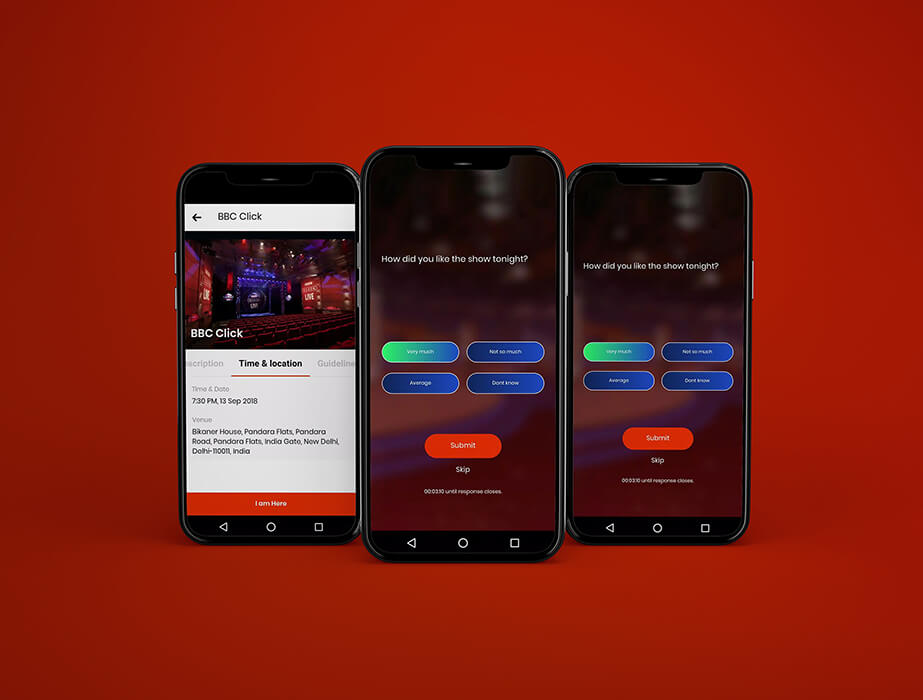

Instant prototype and user flow

Once you’re happy with the journeys and features of your software, you can create a prototype by clicking on 'Preview your app' in the top-right corner.

Sign up and Natasha will create a working prototype of your software. You can click on the screen at different areas to progress through the journey.

You can also see theuser flow by clicking on the 'Flow mode' at the top of the screen to see how users will interact and navigate within your software.

If you need extra help, Natasha is on hand to help and you can interact with her at any time by clicking on 'Speak to Natasha'.

She’ll provide you with suggestions and help you find features or journeys from the library. Or you can click on 'Book a demo' to talk to our product managers who’ll guide you through your software development journey.

Click on 'Save & Continue' to go to the next step and also to save your progress or it might get lost.

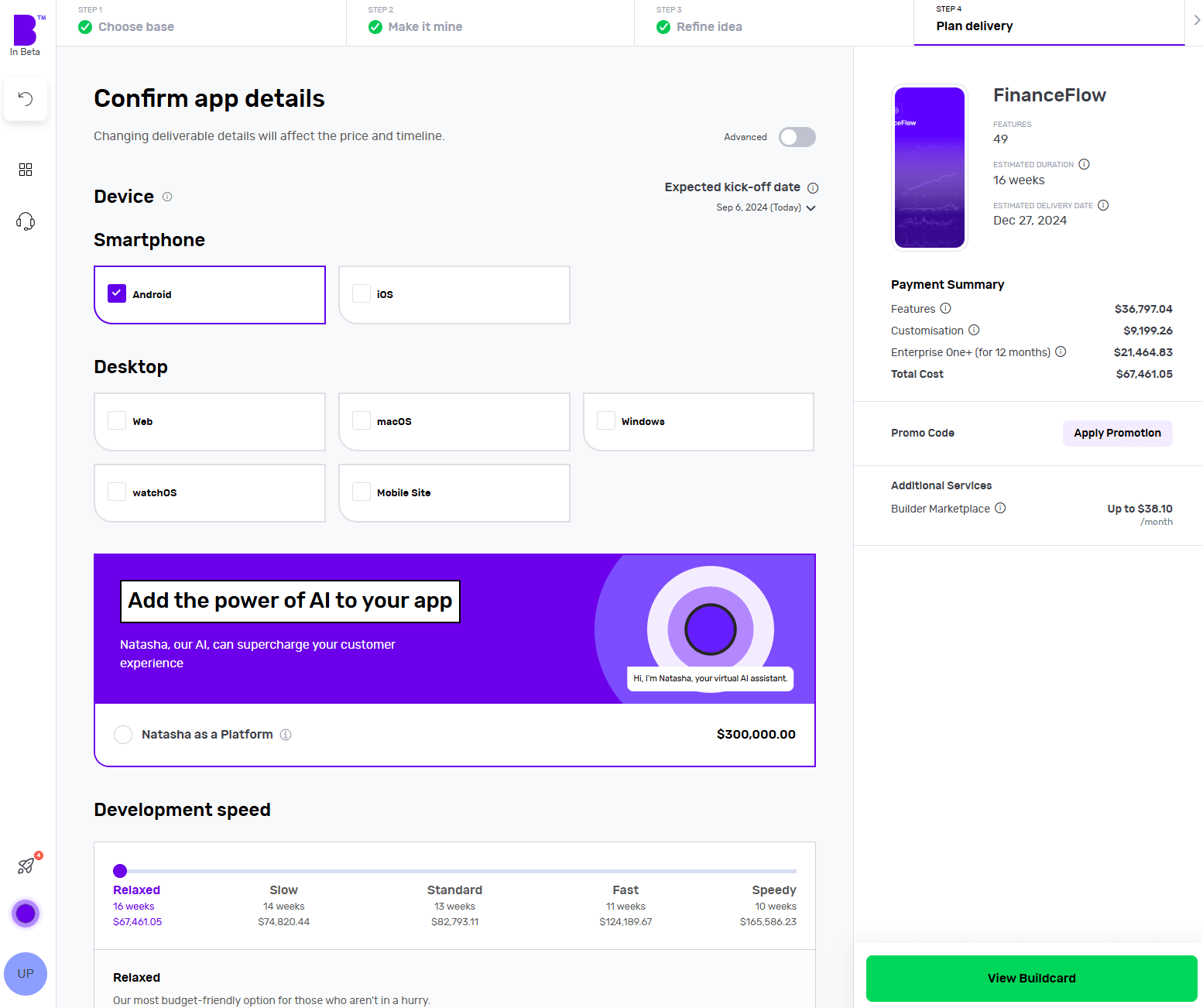

5 - Plan delivery

It’s time to choose the platforms you want your fintech software to be available on. Want a desktop app? Click Windows or macOS. Fancy a mobile app? Hit Android or iOS. Not sure about the platform? Choose multiple platforms and see how it changes the price and timelines.

Next, you can choose to add Natasha to your platform to supercharge the customer experience of your fintech software. Natasha uses Large Language Models (LLMs) to engage your customers in fluid, human-like conversations.

In the development speed section, can change the speed of each phase according to your needs. The faster the development speed, the higher the costs and vice versa.

Next up is Design. If you have your software designs ready, you can save on your costs by clicking 'You have design' and we’ll reduce your costs accordingly. You can share your design files (preferably in Figma) and our designers will upload them, so you can kick off straight away.

If not, you can choose the 'We do your designs' option. Here, you simply need to add your brand assets and we'll do everything from storyboarding to fully designed screens.

Now it’s time to plan the phases of your project. Here you get 3 options:

- Clickable prototype: you’ll get a visual representation of your software to test with users

- Basic build: you’ll get an MVP (Minimum viable product) – a hard-coded but simplified version of your idea; this allows you to collect feedback and iterate before you do a full build

- Full Build: you’ll get market-ready software, including a kick-off with our product team and review sessions

After that, you need to select your support plans. With 'Full Build' you get one year of Studio One support included free of charge.

Once you’ve planned your delivery, click on 'View Buildcard'.

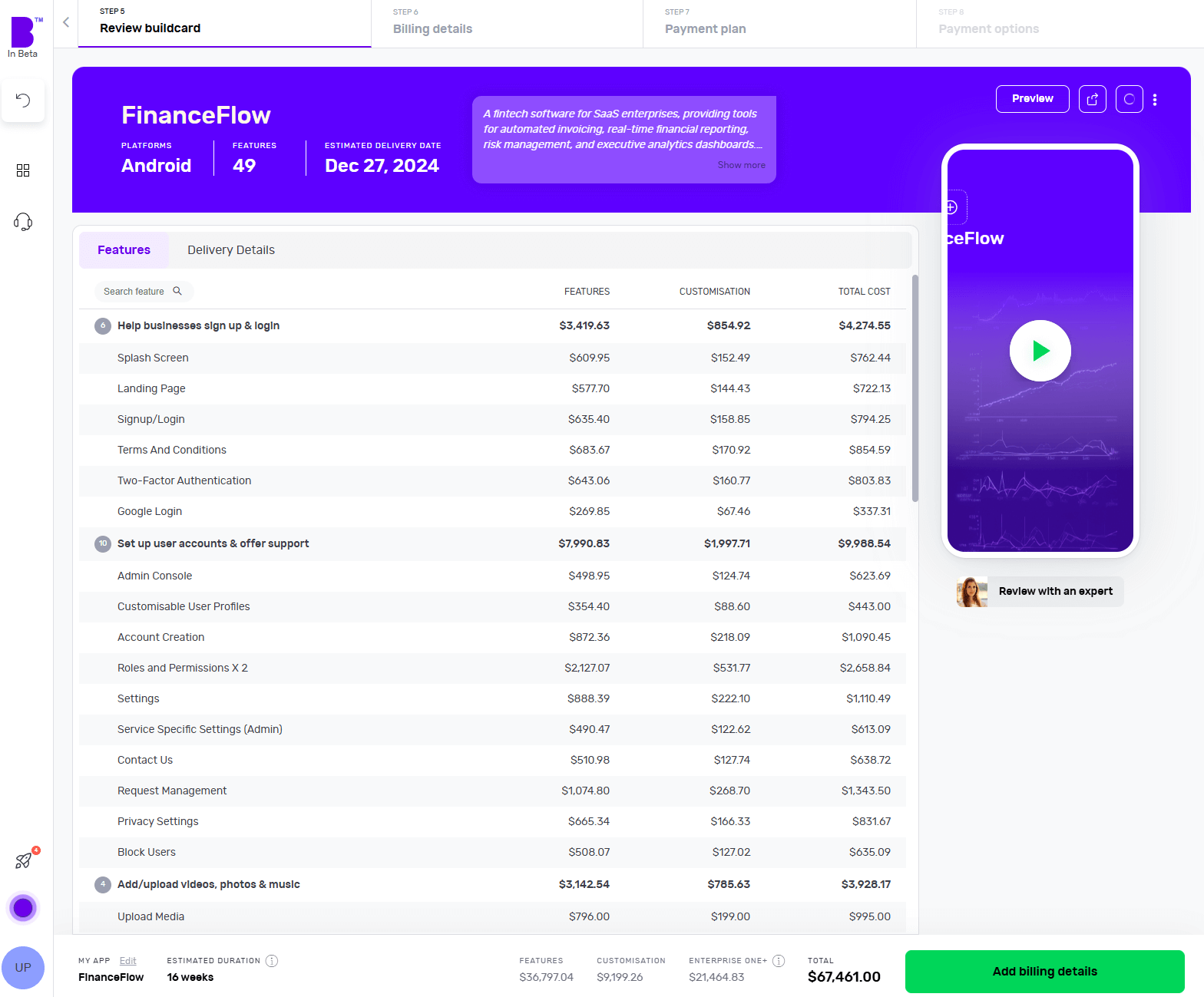

6 - Review Buildcard

Buildcard provides you with a bird's eye view of all the selections you made in the previous steps. Here, you can review all the features, cost per feature and delivery details.

You can also download the PDF of Buildcard or invite others to show your team members what you’re building.

If you want to make any changes, simply click on 'Edit Buildcard' under the 3 dots in the top-right corner.

If you’re happy with everything, click on 'Add billing details' to go to the next section. Alternatively, if you want to review it with experts, click on 'Review with an expert'.

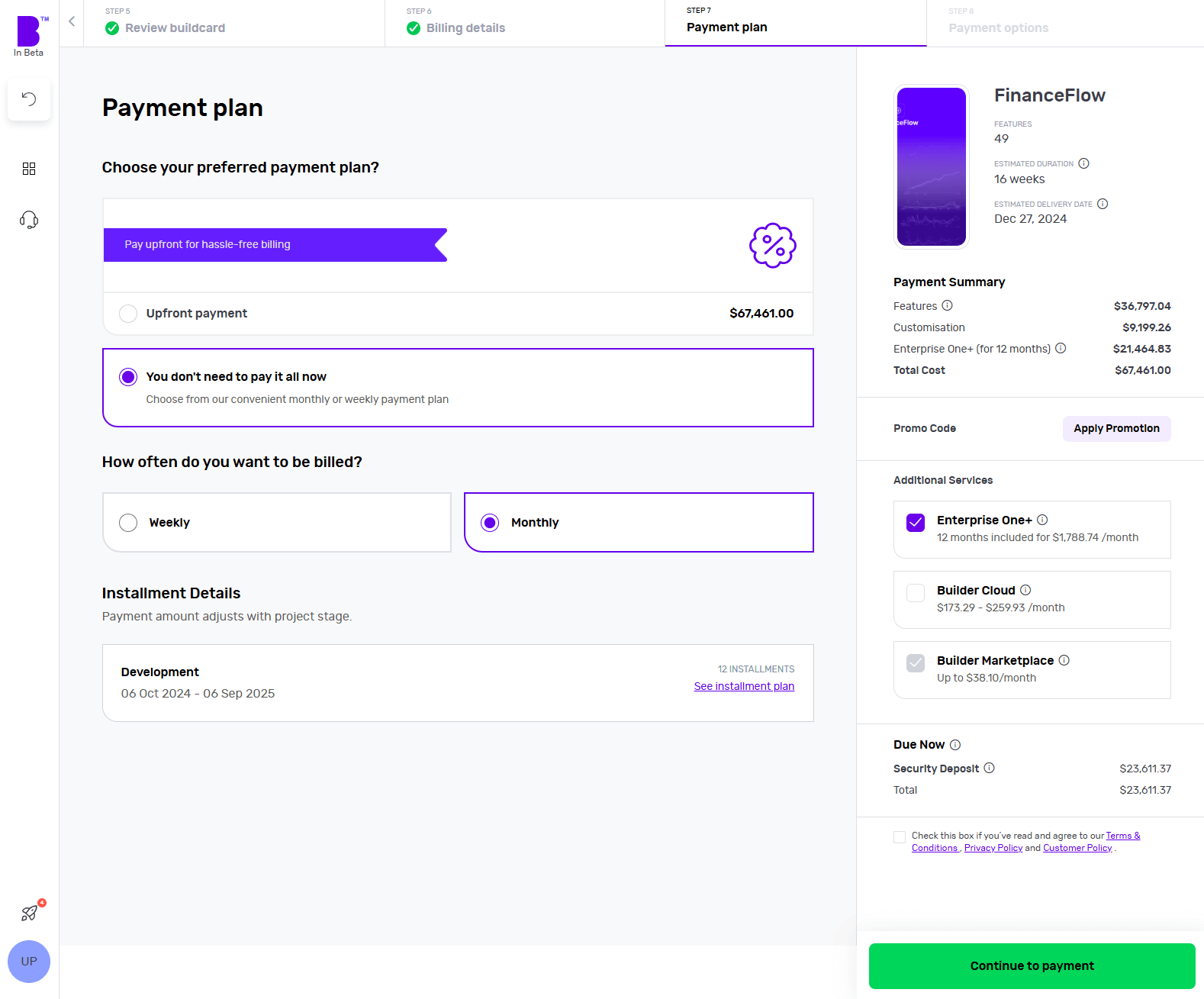

7 - Select your payment plan

We offer weekly or monthly payment instalments, with visible payment dates and amounts for each option. You can also choose to pay upfront to reduce the cost of your build.

Simply select your preferred billing cycle, then click 'Continue' to proceed.

You’ll be asked to input your payment details and agree to the terms and conditions. Once that’s done, click 'Continue to Payment'.

Once your payment is done, you can set up a meeting with our product managers to begin your software development.

8 - Monitor your software build in real-time

With Builder Home, your real-time project dashboard, you can monitor development progress and make sure your software is exactly the way you want it.

This includes access to a suite of collaboration tools to help improve your software design. You can chat with your team of experts in Builder Meet, brainstorm in Builder Whiteboard and visualise your ideas with free Tailor-made prototypes from Builder Now.

How Builder.ai helps fintechs

At Builder.ai, we have a track record of helping fintechs increase their profits and scale their operations 👇

Opigo

Opigo offers users a brand new way of discussing investments and helping users make better financial decisions about the stocks they invest in.

More than 50,000 investors have used OpiGo to connect with friends and experts for better stock picking.

Devansh, founder of Opigo, loved that he was provided with a dashboard where he could see all the priced features upfront and the support he received.

“I would definitely recommend Builder.ai. If you want to bring your idea to life, you need a solid tech partner and Builder.ai has all the capabilities.” - Devansh Mehta, Founder of Opigo.

How Builder.ai keeps your software secure

Builder.ai has a robust, cloud-based security infrastructure. This is divided between Microsoft Azure and AWS (Amazon Web Services), ensuring high availability, scalability and reliability for our services.

Who has access?

Safeguarding our systems and those of our customers and partners is paramount. We operate on a Zero Trust Model, meaning we grant access only when necessary and on a need-to-know basis.

Here's how we manage access:

- Strict controls – we tightly regulate access to all internal services and products

- Least-privilege basis – we follow the principle of least privilege, granting access only to the services required

- Identity access management (IAM) – we use IAM to control access to the cloud providers we use; this ensures that only authorised individuals and systems can interact with the essential services they need

Where do we store data?

Customer data is securely stored in data centres operated by our cloud service providers. These data centres adhere to strict security standards and compliance certifications such as SOC 2, ISO 27001 and GDPR.

What do we do to keep data secure?

Builder.ai is committed to protecting the privacy of customer data and adheres to relevant data protection regulations such as GDPR and CCPA (where applicable). We have comprehensive privacy policies in place.

We subscribe to the AWS and Azure Well-Architected frameworks.

These include:

- Least privilege – we ensure that users have only the necessary access to perform their tasks, enhancing security

- Real-time monitoring – we monitor activities constantly and receive alerts immediately to detect and respond to any suspicious behaviour

- Layered security – we implement security measures at every level to provide comprehensive protection against threats

- Automated best practices – we automate security protocols by embedding them into our code, ensuring consistency and efficiency

- Data protection – we secure data both in transit and at rest to prevent unauthorised access or breaches

- Minimised data access – we limit direct access to data, reducing the risk of exposure to unauthorised individuals

- Incident preparedness – we have a robust incident management process in place to effectively handle security incidents when they occur

You can find out more about our security policy here 👈

Conclusion

Enterprises are operating in a tough landscape, where managing operations efficiently and adhering to compliance is becoming harder by the day. Clinging to traditional financial management techniques may not only slow you down but also limit your ability to adapt and thrive.

Fintech software makes your financial processes more streamlined, secure and data-driven. With the right features and a focus on scalability and integration, fintech software can transform your financial management and help you scale your business.

Hit the banner below and kick off your fintech software project with us today 👇

Create robust custom software today

100s of businesses trust us to help them scale.

Book a demoBy proceeding you agree to Builder.ai’s privacy policy

and terms and conditions

Gaurav is the SEO Content Writer at Builder.ai. Being an Engineer and Marketing MBA, he has a knack for converting technical jargon into marketing content. He has 8+ years of experience creating content and designing marketing campaigns that drive organic growth for B2B companies and tech startups.

Facebook

Facebook X

X LinkedIn

LinkedIn YouTube

YouTube Instagram

Instagram RSS

RSS